Video Games retail / e-tail sales in U.S. August 2013

These sales figures represent new physical retail sales of hardware, software and accessories, which account for roughly 50 percent of the total consumer spend on games. When taking into account our preliminary estimate for other physical format sales in August such as used and rentals at $178 million, and our estimate for digital format sales including full game and add-on content downloads including micro-transactions, subscriptions, mobile apps and the consumer spend on social network games at $528 million, the total consumer spend in August is just over $1.2 billion.

- NPDs final assessment of the consumer spend in these areas outside of new physical retail sales will be reported in November in its Q3 2013 Games Market Dynamics: U.S. report.

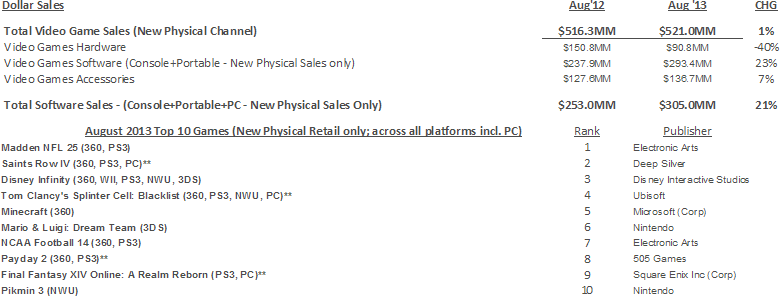

August 2013 retail video game grew a modest 1% over August 2012 as growth in software and accessories offset soft hardware sales as we near the launch of the Xbox One and PS4. Excluding January 2013, which was up due to an extra reporting week versus January 2012, the last time overall retail video game sales (hardware, software, and accessories) were up year over year was October 2011.

NPD Group's U.S. Games Industry Sales (New Physical Sales Channel*) - August 2013

4-week month; Reporting Period 8/4/13 through 8/31/13

Hardware

Nintendo's 3DS continued to outsell other hardware platforms for the fourth month straight. The Xbox 360 was the top selling console for the month, which was the thirty-second consecutive month it has led console sales.

Hardware sales were down 40% year over year as every platform experienced a decline. We hope to see hardware sales improve with the launch of the Xbox One and PS4 in November.

Software

Video game retail software sales had their first positive month, up 23 percent, since November 2011. This was driven by the shift of Madden into the August data month and other launches such as Saints Row IV, Disney Infinity and Tom Clancy's Splinter Cell: Blacklist. In fact, eight of the top ten games this month were launched in August.

Collectively, August 2013 launches made up an astounding 58 percent of overall dollar sales for the month and 41 percent of units sales, which compared to 24 percent of dollar sales and 15 percent of unit sales that August 2012 launches represented in that month. Due to a greater percentage of sales stemming from newer games at full price and have higher priced collector's editions, overall software average pricing grew by 25 percent.

Xbox 360 and PS3 software sales combined to grow over 50 percent and are now only down only one percent year to date. This is remarkable considering how close we are to the launch of their successors, the Xbox One and PS4.

We continue to see support for the 3DS each month with new launches, and this month was no exception as Mario and Luigi: Dream Team was released and ranked as the sixth highest-selling game this month.

If we were to rank the top ten games on a SKU basis, PS3 TALES OF XILLIA would have made the top 10 for August. On a title basis, including all SKUs, Tales of Xillia ranked just outside of the top 10 at number 11.

Further demonstrating the strength of the launch-heavy top 10 ranking, the top 10 games in August 2013 sold more than double the sales than the top 10 games in August 2012.

Accessories

August 2013 marked the anticipated launch of Disney Infinity and its set of Interactive Gaming Toys*. Combined with sales of Skylanders accessories, one in every three accessory sold this month was an Interactive Gaming Toy.

Sales of Video Game and Subscription cards were also strong in August 2013, and when combined with Interactive Gaming Toys, these two types of accessories represented over 50 percent of dollar sales this month.